Boost Investment Success with Effective Real Estate Syndication

Real estate syndication is a powerful investment strategy that enables individuals to pool their financial resources to invest in larger real estate projects. By combining the efforts of both active investors (syndicators) and passive investors, syndication opens up opportunities that would typically be inaccessible to individual investors. Whether it’s a commercial property, multifamily housing, or large-scale development, real estate syndication creates a structured way for investors to collectively participate in lucrative property deals without the need for hands-on management. For those seeking a way to diversify their investment portfolios or enter the real estate market with minimal risk, syndication is an attractive option.

What is Real Estate Syndication?

Real estate syndication is a structured method of pooling capital from multiple investors to collectively purchase or develop large real estate properties that would typically be out of reach for individual investors. In this process, a syndicator, also known as a sponsor, takes on the active role of identifying, acquiring, and managing the property, while passive investors contribute financially. The investors earn a share of the profits generated from the property, such as rental income or proceeds from the eventual sale, without needing to manage the property themselves. This model provides access to lucrative, large-scale investments such as commercial buildings, multifamily units, and large developments.

Real estate syndication is appealing because it allows smaller investors to participate in real estate markets by owning fractional shares of larger properties. It combines the expertise of the syndicator with the financial resources of multiple investors, offering opportunities for both passive income and property appreciation. Additionally, syndications can deliver tax advantages, such as depreciation benefits, which are passed down to investor.

What Are Common Types of Real Estate Syndication Deals?

Real estate syndication deals are primarily categorized into three types: equity syndications, debt syndications, and hybrid syndications.

- Equity syndication involves investors pooling their money to acquire ownership of a property. In this model, investors share both the risks and rewards, as they benefit from rental income and any property appreciation over time. Equity syndications are common in large apartment buildings, commercial properties, and development projects.

- Debt syndication works similarly to traditional lending. In this model, investors provide loans to real estate developers or property owners, and they receive interest payments on their investment. While less risky than equity syndications, the potential upside is also lower as investors don’t share in the property’s appreciation.

- Hybrid syndication combines elements of both equity and debt, giving investors a mix of ownership benefits while also receiving regular interest payments. This model is often used when flexibility in investment strategy is required.

What Documents Are Required for a Real Estate Syndication Agreement?

The legal foundation of a real estate syndication involves several key documents that outline the responsibilities and rights of all parties involved. These documents ensure transparency and protect both the syndicator and the investors.

- Private Placement Memorandum (PPM): This legal document details the terms of the investment, including risks, the business plan, and how the syndication is structured. It’s essentially a disclosure document required by securities laws.

- Operating Agreement: This agreement outlines the roles and responsibilities of the syndicator and the investors, including decision-making authority, profit distribution, and exit strategies. It also defines the structure of the entity (often an LLC) that holds the property.

- Subscription Agreement: Investors sign this document to formalize their investment in the syndication. It serves as a contract that commits the investor to provide the agreed-upon capital in exchange for an ownership stake in the project.

These documents are crucial for protecting investor interests and ensuring that the syndication complies with legal and regulatory standards.

How Does Real Estate Syndication Work?

Real estate syndication functions through the collaboration between a syndicator (or sponsor) and a group of passive investors. The syndicator typically identifies the investment opportunity, handles the acquisition process, manages the property, and oversees its eventual sale. In contrast, passive investors provide the capital needed to fund the project but remain hands-off in its day-to-day operations. The syndicator may invest a small portion of capital to align interests with the investors, but the bulk of the funding comes from the investor pool.

The syndicator is compensated through various fees, such as acquisition fees and asset management fees. Investors earn money from both short-term cash flow, usually through rental income, and long-term profits upon the sale of the property. The arrangement allows investors to enjoy the benefits of property ownership, such as appreciation and tax advantages, without the hassles of property management.

What Are the Key Steps to Starting a Real Estate Syndication?

Starting a real estate syndication requires a methodical approach and strong attention to legal, financial, and operational details. Below are the key steps involved:

- Finding the Right Property: The first step is identifying a property that fits your investment criteria. This involves evaluating factors such as location, potential return on investment (ROI), and overall market conditions. Many syndicators work closely with brokers or agents to locate off-market deals that may provide better returns.

- Researching the Market: Before proceeding with a property, the syndicator must conduct extensive market research. This includes analyzing local economic conditions, demographic trends, and comparable property sales. The goal is to ensure the property has strong potential for growth and income.

- Structuring the Deal and Finding Investors: After identifying a suitable property and running financial projections, the syndicator must structure the investment. This includes setting up a legal entity (usually an LLC) and drafting partnership agreements. The next step involves raising capital by reaching out to potential investors, often through private networks or real estate investment platforms.

Once these steps are completed, the syndicator finalizes the purchase, takes ownership on behalf of the investor group, and begins property management or improvement strategies to maximize returns.

How Are Profits Distributed in Real Estate Syndication?

In a real estate syndication, profits are distributed based on an agreed-upon structure between the syndicator and the investors, which is usually outlined in the operating agreement. Typically, there are two primary ways that profits are distributed: ongoing income from rents and capital gains upon sale.

- Rental Income: Investors receive a percentage of the rental income generated from the property. This cash flow is usually distributed quarterly or annually and is proportional to each investor’s ownership share in the syndication. For instance, if an investor owns 10% of the syndication, they will receive 10% of the net rental income after expenses like property management and maintenance.

- Capital Gains from Property Sale: Once the property is sold, the profits are distributed after deducting costs such as closing fees and remaining mortgage balances. Investors typically receive a percentage of the sale proceeds based on their ownership share. In some deals, syndicators may receive a promote or carried interest, which provides them with a bonus if the property performs well and exceeds return expectations.

This profit-sharing structure allows investors to benefit from both short-term cash flow and long-term property appreciation, making syndication an attractive option for those looking to diversify their investment portfolios with minimal involvement.

What Are the Roles in a Real Estate Syndication Deal?

In a real estate syndication, two primary roles exist: the syndicator (or sponsor) and the passive investor. These roles are crucial in ensuring the success of the investment. While the syndicator handles all the active aspects of the deal, the passive investors contribute capital and rely on the syndicator’s expertise to generate returns.

What is the Difference Between a Syndicator and a Passive Investor in Syndication?

The syndicator is the individual or entity responsible for the acquisition, management, and eventual sale of the property. This role involves scouting potential real estate opportunities, conducting due diligence, raising capital, and overseeing the day-to-day operations of the property. The syndicator typically invests a small portion of their own capital (5-10%) to align their interests with the investors, but their primary role is managing the investment. In exchange for their efforts, syndicators are compensated through management fees and a share of the profits, often referred to as a “carried interest” or equity split, typically ranging from 20% to 30%.

On the other hand, passive investors, also known as limited partners (LPs), provide the bulk of the capital for the investment. Their role is limited to funding the deal, and they do not participate in the management or decision-making processes. Investors receive returns from rental income and profits upon the sale of the property, with typical equity splits favoring the passive investors (e.g., 70% to the LPs). Passive investors enjoy the benefits of property ownership without being involved in the operational aspects.

What Role Do Property Managers Play in Real Estate Syndication?

In real estate syndication, property managers play a critical operational role, particularly when the syndicator opts to delegate day-to-day management. Property managers handle tasks such as rent collection, maintenance, tenant relations, and lease management. They are essential in ensuring that the property remains well-maintained, fully tenanted, and profitable over the holding period. The syndicator may oversee the property manager’s performance to ensure that the investment adheres to the business plan and meets its financial goals.

By ensuring smooth operations and maintaining tenant satisfaction, property managers indirectly contribute to maximizing the returns for both the syndicator and the passive investors. This allows the syndicator to focus on strategic decisions such as market analysis, financing, and property improvements, further enhancing the value of the investment.

What Are the Benefits of Real Estate Syndication for Investors?

Real estate syndication offers several key benefits for investors, particularly those seeking to diversify their portfolios or generate passive income. One of the primary advantages is access to larger, potentially more profitable properties that would typically be unattainable for individual investors. By pooling resources with other investors, participants can invest in high-value properties, such as commercial real estate or multifamily units, which can provide substantial returns through rental income and appreciation.

Additionally, syndication allows investors to benefit from tax advantages, such as depreciation deductions, which can offset other income and reduce the overall tax burden. This makes it a compelling investment option for accredited and sophisticated investors who seek to maximize returns while minimizing hands-on involvement. Another major perk is passive income—investors receive rental income without the day-to-day responsibilities of property management, as this is handled by the syndicator.

How Can a Real Estate Syndication Be Scaled for Larger Investments?

Scaling a real estate syndication involves leveraging both capital and expertise to pursue larger, more complex projects. One key method is raising more capital from a larger pool of investors. This often requires building strong networks, utilizing online syndication platforms, and potentially engaging institutional investors. The larger the capital raised, the more significant and lucrative the property investments can become.

Another approach to scaling is diversification across multiple types of properties or geographic locations. For example, instead of focusing solely on residential multifamily units, a syndicator might expand into commercial real estate, industrial properties, or mixed-use developments. This reduces risk and opens up new revenue streams. Successful syndicators often implement more advanced asset management strategies, using professional property managers and financial analytics to ensure higher returns and sustainable growth.

What Platforms or Tools Are Available for Real Estate Syndication?

Several online platforms have emerged to facilitate real estate syndication, helping both syndicators and investors streamline the process. Some of the top platforms include CrowdStreet, RealtyMogul, and YieldStreet.

- CrowdStreet is a popular platform that connects accredited investors with commercial real estate deals. It offers a wide range of investment opportunities, from office spaces to multifamily units, with an emphasis on high returns and portfolio diversification.

- RealtyMogul provides both individual deals and REITs, catering to accredited and non-accredited investors alike. With a minimum investment of $5,000 for REITs, it’s accessible for those looking to start small while accessing institutional-grade investments.

- YieldStreet offers a diverse range of alternative investments, including real estate, art, and venture capital. Their platform is known for its flexibility, allowing investors to choose between debt and equity investments with varying risk levels.

These platforms make it easier for syndicators to raise capital and for investors to access vetted real estate deals, promoting transparency and simplifying the syndication process.

What are the Risks Involved in Real Estate Syndication?

While real estate syndication offers attractive potential returns, it also comes with various risks. One of the primary risks is market volatility. Changes in property values, interest rates, or economic downturns can significantly impact the returns from a syndicated investment. Syndications often rely on rental income and property appreciation, and adverse market conditions can lead to lower than expected returns or even losses

Another risk is illiquidity. Real estate syndications typically require long-term commitments, often between 5 to 7 years, during which investors have limited or no access to their capital. Investors must be comfortable with the idea that they won’t be able to quickly sell or liquidate their shares.

Additionally, the success of the investment depends heavily on the syndicator’s expertise. Poor management, failure to execute the business plan, or ineffective property management can lead to financial losses.

What Legal Considerations Apply to Real Estate Syndication?

Real estate syndications are regulated under securities law, specifically through the U.S. Securities and Exchange Commission (SEC). Syndicators must comply with regulations, such as filing under Regulation D exemptions, which allow capital raising without registering the offering with the SEC. Most syndications operate under Rule 506(b) or Rule 506(c) of Regulation D, which dictates whether general solicitation is allowed and whether only accredited investors can participate.

Investors must be provided with a Private Placement Memorandum (PPM), a legal document that outlines the terms of the investment, associated risks, and the rights of the investors. It is essential to carefully review the PPM, as it governs how the investment operates and what legal obligations both syndicators and investors have. Furthermore, syndications must comply with state and local real estate laws, making it important for syndicators to have knowledgeable legal counsel to navigate these complex requirements.

What Are the Exit Strategies in Real Estate Syndication?

Exit strategies are a critical aspect of real estate syndications, as they define how investors will recoup their capital and earn returns. The most common exit strategy is the sale of the property after a specified holding period, usually around 5-7 years, or when market conditions are favorable. The proceeds from the sale are then distributed to investors.

Other potential exit strategies include refinancing the property to capture its increased value while allowing investors to retain ownership. In some cases, syndicators may also execute a 1031 exchange, which allows the proceeds from the sale to be reinvested in another property without immediate tax consequences. The choice of exit strategy depends on market conditions and the specific goals outlined in the business plan.

How to Find a Real Estate Syndication Deal?

Finding a real estate syndication deal often begins with building the right network and utilizing online platforms. For accredited investors, platforms like CrowdStreet, RealtyMogul, and Fundrise offer a wide selection of vetted syndication deals, making it easier to find investment opportunities. These platforms typically provide details on property types, investment terms, and projected returns, allowing investors to assess their options quickly.

For non-accredited investors, finding deals may be more challenging, as many syndications are limited to accredited investors. However, networking within real estate investment groups, attending local meetups, and joining online forums like BiggerPockets can be excellent ways to uncover private syndication opportunities. In addition, building relationships with syndicators directly or attending real estate conferences can expose you to off-market deals that aren’t widely advertised.

How to Evaluate a Real Estate Syndication Deal?

Evaluating a real estate syndication deal involves a detailed analysis of both the sponsor and the investment opportunity. First, you should review the sponsor’s track record and experience. Look at how many deals they’ve successfully completed, their specialization (e.g., multifamily or commercial properties), and their performance in different markets. It’s also critical to understand their business model, including how they handle risk and execute on value-add strategies.

Beyond the sponsor, scrutinize the deal itself by analyzing its financial structure. This includes examining the projected cash flow, equity splits, and any waterfall payment structures. A preferred return for investors—where investors receive payments before the sponsor—can be a good indicator of alignment between the sponsor’s and investors’ interests. Additionally, assess potential tax advantages like depreciation that could reduce your tax liability(

How to Raise Capital for a Real Estate Syndication Deal?

Raising capital for a real estate syndication deal involves combining personal networks with strategic outreach. Common sources include friends and family, real estate investment clubs, and private investors. In today’s digital age, crowdfunding platforms like RealtyMogul or Fundrise can help syndicators access a broader pool of investors. These platforms connect syndicators with individuals who are looking for passive real estate investment opportunities.

For larger deals, syndicators may also turn to institutional investors or family offices, though these typically require extensive track records and larger deal sizes. It’s crucial to structure the investment terms clearly, ensuring that investors understand the risks, timelines, and projected returns before committing their capital.

What Legal Considerations Apply to Real Estate Syndication?

Real estate syndication involves complex legal considerations, as it falls under securities law in the U.S., which means syndicators must comply with regulations enforced by the Securities and Exchange Commission (SEC). Most syndications operate under Regulation D, specifically Rule 506(b) or Rule 506(c). These rules allow syndicators to raise capital from accredited investors without needing to register the offering with the SEC. For 506(b) offerings, syndicators can raise funds from a mix of accredited and up to 35 non-accredited investors, while 506(c) allows for general solicitation but restricts participation to accredited investors only.

Syndicators are also required to draft legal documents like the Private Placement Memorandum (PPM) and Operating Agreement, which outline the terms of the investment, the risks involved, and the responsibilities of both syndicators and investors. Additionally, syndicators must comply with state and local real estate laws, making it crucial for them to work with experienced attorneys to avoid legal pitfalls.

What Are the Tax Implications of Real Estate Syndication?

From a tax perspective, real estate syndications provide several advantages, primarily through depreciation and passive loss deductions. Investors in syndications often qualify as passive investors, meaning they can use depreciation and other expenses to offset their passive income. This can create paper losses that reduce taxable income, even while generating positive cash flow from rental income.

Another major tax consideration is the capital gains tax when the property is sold. Investors pay tax on the profit made from the sale, but at a lower rate than ordinary income. In some cases, syndications may use 1031 exchanges to defer capital gains taxes by reinvesting the proceeds into another property.

How Are Risks Managed in Real Estate Syndication?

Risks in real estate syndications are managed through a combination of due diligence, diversification, and careful deal structuring. Due diligence involves thoroughly vetting the property, market conditions, and financial projections. This helps ensure the investment aligns with both the syndicator’s and investors’ goals. Syndicators also mitigate risk by diversifying investments across different property types or geographic locations, which reduces exposure to market fluctuations.

Additionally, syndicators often include specific clauses in the syndication agreement to manage risks, such as the right to refinance the property if necessary or an exit strategy in case market conditions change. Well-structured deals with preferred returns for investors and clear communication from the sponsor also play a critical role in managing risks.

What Are the Financial Aspects of Real Estate Syndication?

Real estate syndication offers significant financial benefits to both syndicators and investors through income distributions and various fee structures. The financial aspects of syndications primarily revolve around profit distributions and fees, both of which are important to understand when participating in or managing a syndication.

How Are Syndication Profits Distributed?

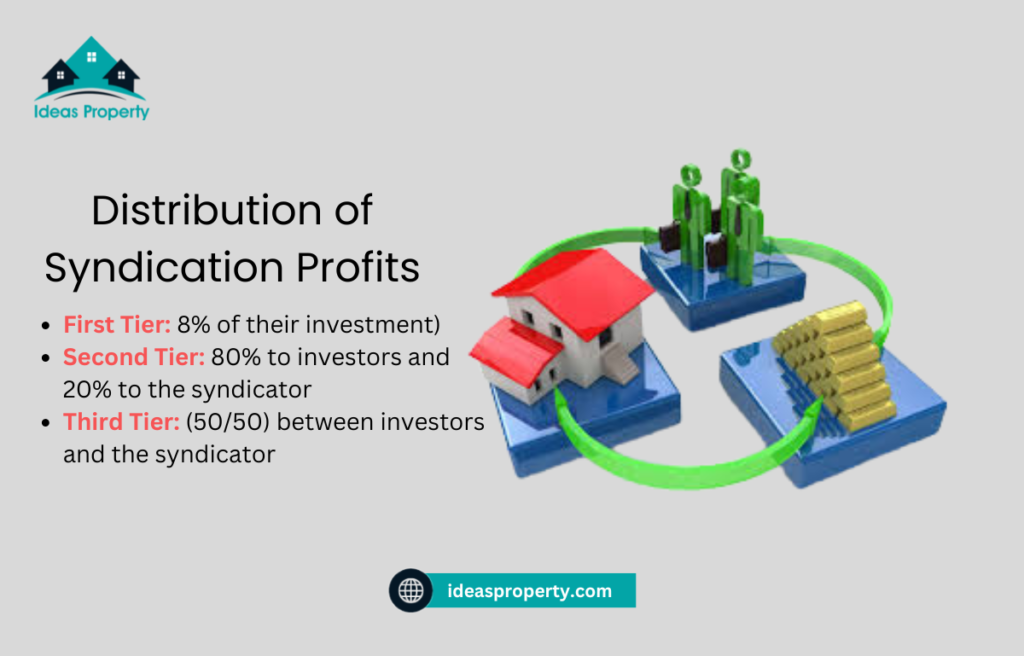

Profit distribution in real estate syndication follows a specific structure laid out in the syndication agreement. Typically, preferred returns are given to investors first, meaning they receive a pre-defined percentage of profits before the syndicator takes a share. For example, investors may receive an 8% preferred return annually. After that, any remaining profits are divided based on the ownership structure.

These returns are usually distributed using a waterfall structure, which incentivizes both the syndicator and the investors. In a typical three-tier waterfall structure:

- First Tier: Investors receive their preferred return (e.g., 8% of their investment).

- Second Tier: Any profits beyond this are split (e.g., 80% to investors and 20% to the syndicator) until a higher return is met.

- Third Tier: If the returns exceed a certain threshold, profits might be split equally (50/50) between investors and the syndicator. This tiered structure ensures that the syndicator only benefits significantly when the investors see higher returns on their investment.

What Are the Common Fee Structures in Real Estate Syndication?

Syndicators charge various fees for managing the syndication process, from property acquisition to eventual sale. Common fees include:

- Acquisition Fee: This fee compensates the syndicator for finding and purchasing the property. It usually ranges between 1-3% of the property’s purchase price.

- Asset Management Fee: For ongoing management of the property and oversight of the investment, syndicators charge an asset management fee, typically around 1-2% of the property’s gross monthly income.

- Disposition Fee: This fee is charged when the property is sold, typically ranging from 1-2% of the sale price. It covers the costs involved in marketing and facilitating the sale.

- Equity Placement Fee: Charged for raising capital from investors, this fee is generally 1-2% of the capital raised for the investment.

These fees compensate the syndicator for their time, expertise, and effort in managing the syndication, but they also impact the overall returns investors receive. Therefore, it’s essential for investors to thoroughly review the fee structure outlined in the Private Placement Memorandum (PPM) before committing to a deal.

Real estate syndication offers a powerful investment strategy by allowing investors to pool their capital for large-scale projects, while benefiting from passive income, tax advantages, and the expertise of experienced syndicators. It opens the doors to investments that may otherwise be inaccessible to individual investors. The financial aspects of syndication—ranging from profit distributions via preferred returns to a variety of fees—are critical in understanding how returns are structured for both investors and syndicators.

When investing in syndications, it’s crucial to perform thorough due diligence on the deal structure, syndicator experience, and market potential to ensure alignment with your financial goals. Real estate syndications, particularly in commercial real estate, present compelling opportunities for portfolio diversification and long-term wealth creation. However, understanding the complexities of fees and profit distribution mechanisms is key to maximizing returns and making informed investment decisions.